Hotline

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

info@celeblaws.com

info@celeblaws.com

中文版

中文版

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

info@celeblaws.com

info@celeblaws.com

中文版

中文版

Estate Planning and the Three Estate Planning Items Everyone Needs

刘庆贺律师事务所专栏/Column of Law Offices of Liu and Associates, P.A.

By Mark McMillan, Esq. and Ying Yu, Esq.

Believe it or not, you have an estate. In fact, nearly everyone does. Your estate is comprised of everything you own— your car, home, other real estate, checking and savings accounts, investments, life insurance, furniture, personal possessions. No matter how large or how modest, everyone has an estate and something in common—you can’t take it with you when you die.

When that happens—and it is a “when” and not an “if”—you probably want to control how those things are given to the people or organizations you care most about. To ensure your wishes are carried out, you need to provide instructions stating whom you want to receive something of yours, what you want them to receive, and when they are to receive it. You will, of course, want this to happen with the least amount paid in taxes, legal fees, and court costs.

That is estate planning—making a plan in advance and naming whom you want to receive the things you own after you die. However, good estate planning is much more than that. It should also:

· Include instructions for passing your values (religion, education, hard work, etc.) in addition to your valuables.

· Include instructions for your care if you become disabled before you die.

· Name a guardian and an inheritance manager for minor children.

· Provide for family members with special needs without disrupting government benefits.

· Provide for loved ones who might be irresponsible with money or who may need future protection from creditors or divorce.

· Include life insurance to provide for your family at your death, disability income insurance to replace your income if you cannot work due to illness or injury, and long-term care insurance to help pay for your care in case of an extended illness or injury.

· Provide for the transfer of your business at your retirement, disability, or death.

· Minimize taxes, court costs, and unnecessary legal fees.

· Be an ongoing process, not a one-time event. Your plan should be reviewed and updated as your family and financial situations (and laws) change over your lifetime.

Estate planning is for everyone.

It is not just for “retired” people, although people do tend to think about it more as they get older. Unfortunately, we can’t successfully predict how long we will live, and illness and accidents happen to people of all ages.

Estate planning is not just for “the wealthy,” either, although people who have built some wealth do often think more about how to preserve it. Good estate planning often means more to families with modest assets, because they can afford to lose the least.

Many people mistakenly believe that estate planning is only necessary for the wealthy. In reality, a basic estate plan is essential for everyone, regardless of income or net worth, because we all want to minimize confusion, unnecessary costs, and stress for loved ones after a death.

Estate planning can be a difficult topic for many families to address, but it’s a necessary one. Without proper preparation and documentation, assets—like houses, retirement plans and savings accounts—can end up in limbo for years, sometimes requiring expensive legal assistance to straighten matters out.

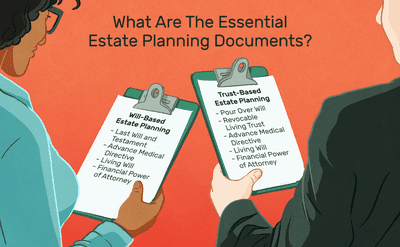

At a minimum, everyone should have the following three items in place:

1. An up-to-date will or trust.

Wills are easy to create, but they require the distribution of assets to go through probate. Probate is a legal process that involves:

· Validating a deceased person’s will;

· Identifying, inventorying, and appraising the deceased person’s property

· Paying debts and taxes;

· And ultimately distributing the remaining property as the will directs.

The probate process often requires a lot of technical paperwork and court appearances, and the resulting legal and court fees are paid from estate property—reducing the amount that’s passed on to heirs.

A trust can be more expensive to set up and requires professional assistance, but it provides benefits that a will cannot. First, when they’re structured properly, trusts will help avoid guardianship or conservatorship if you become incapacitated. A will only works after you've died; a trust, by contrast, works all the time, including periods of incapacity before death.

Trusts usually avoid probate, which helps beneficiaries gain access to assets more quickly as well as save time and court fees. Depending on how it’s structured, a trust may also reduce estate taxes owed and can protect an estate from heirs’ creditors.

2. A durable power of attorney.

A power of attorney is a written authorization that allows someone else to make financial and legal decisions for a person if that person should become hospitalized, disabled or otherwise incapacitated.

Not all powers of attorney are created equal. Some are put in place for short periods of time only—while a person is vacationing overseas but dealing with legal matters at home, for example. That’s why it’s important to have a durable power of attorney in place, which simply means that the agreement is not for a temporary period of time. It may be valid immediately when it’s signed, or it may go into effect at a later point. But what makes it “durable” is the fact that it will survive your later incapacity. (If a power of attorney is not durable, it is revoked when you become incapacitated – the very moment when you need it most.)

Powers of attorney for property should only be given to trusted individuals, ideally those who are good with financial and legal matters. Medical powers of attorney can be separated and given to someone else, if desired.

3. Updated beneficiary designation forms.

Beneficiary designation forms on life insurance policies, 401(k) accounts and other assets will generally override any conflicting provisions within a will or trust. It’s essential to make sure all forms are checked and updated regularly, ideally on an annual basis.

An estate planning professional can help anyone create or update these basic items as well as provide suggestions for additional steps, if needed.

The copyright belongs to the Law Offices of Liu and Associates, P.A.

All materials have been prepared for general information purposes only to permit you to learn more about our firm, our services and the experience of our attorneys. The information presented is not legal advice, is not to be acted on as such, may not be current and is subject to change without notice.

Telephone:407-930-8082 (US Orlando)

Telephone:212-653-8082 (US New York)

Telephone:0086-0755-86533531 (CN Shenzhen)

Email:info@celeblaws.com

Orlando: 5050 W Colonial Drive, Orlando, FL 32808, USA

New York: 276 Fifth Avenue Suite 704, New York, NY 10001, USA

Shenzhen:5109 SCIA Tower Tinghai Road, Room 2402, Nanshan Area, Shenzhen, China