Hotline

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

info@celeblaws.com

info@celeblaws.com

中文版

中文版

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

CN:0086-0755-86533531 US:407-930-8082, 212-653-8082

info@celeblaws.com

info@celeblaws.com

中文版

中文版

Labor Law Brief Introduction II

刘庆贺律师事务所专栏/Column of Law Offices of Liu and Associates, P.A.

Ying Yu, Esq. and Mark McMillan, Esq.

In the last weekly article Labor Law Brief Introduction I, we briefly introduced the issues and appeals in labor law area generally faced by our clients. In this article, we will continue to discuss topics related to labor law.

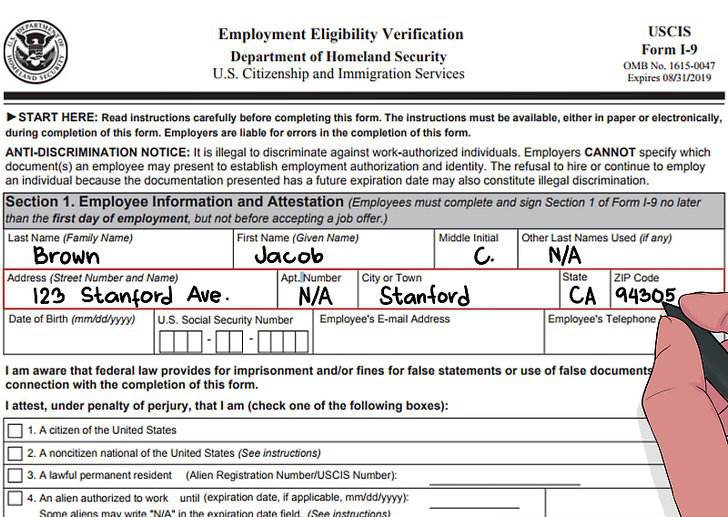

Many clients tell us that they have been notified by the immigration authority to submit their I-9 forms for inspection. It is apparent that some clarification on I-9 forms would be helpful. We would like to give a brief introduction of this form and relevant issues.

The agency that issues an I-9 form inspection request to an employer is ICE (Immigration and Customs Enforcement), the Immigration Enforcement Agency, and ICE’s frequently targets the food service and construction industry. With hints that ICE is ramping up its I-9 enforcement and compliance efforts, ICE will be likely issuing Notice of Inspection and Subpoenas around the state. As a result, if you have not received the subpoena as an employer, now it is the best time to review the I-9 form and standardize your record keeping system.

If a subpoena is received, in general, the initial subpoena is for records of all current and former employees during the I-9 form retention period required by law. After receiving the inspection notice, the employer has a maximum of 72 hours (3 working days) to reply to the subpoena and check the notice.

ICE will not give the employer extra time to respond to the subpoena. At the moment you receive the subpoena, please call a lawyer. It would be great if you had time to conduct an internal audit through a trained legal person. The cost of internal auditing is only a small fraction of I-9 violation fines, attorney fees, and income losses caused by ICE comprehensive inspections.

The penalty imposed by ICE is not just for unauthorized employment. Although the I-9 form is only two pages, it may take a lot of time for employers if there is no rock-solid HR policy and well-trained staff to handle I-9 employment verification. Any defect in the I-9 form, like the employee's name is not placed at the top of the second fillable page, or an expired form is used, can result in the employer being fined.

Here, are some helpful measures that employers can take to ensure they do not get fined by ICE.

• Develop a unified, written I-9 compliance policy and train employees.

• Establish a calendar system that informs HR staff that an individual with a temporary employment permit is about to be re-verified.

•Establish best practices, appropriate cataloging and retention of I-9, separating I-9 from former employees and active employees.

• Separate the I-9 form from the general personnel file.

The following are some of the most common I-9 form errors:

1. The form was submitted too late,

2. The form was incomplete,

3. The information and time were filled in incorrectly, and

4. The record was over-recorded (although it seems that the employer is trying to verify that the employee is legally eligible to work in the US by requesting as many documents as possible, but the employer cannot ask for any excess The content required by the form.)

Any corrections or changes made by the Employer to I-9 must be signed and dated by the Employer's Agent. If Part 1 needs to be corrected, the employee must make corrections (sign and date near corrections). Any mistake must be made in one line. Drop it. It is a violation to use White Out or Correction Fluid on the I-9 meter.

Fortunately, employers can correct most violations in the I-9 internal audit. Uncorrectable errors are still be able to be resolved in internal audit. As a part of the internal audit (voluntarily carried out by the employer), the notes added to the employee's file, indicating the reasons for the uncorrectable, are very helpful in establishing the employer's integrity efforts and adhering to the employment qualification. When an employer has evidence that they are reviewing compliance with their I-9 form and they make every effort to correct any errors and maintain their obligations under the law, the ICE auditor will consider the evidence when reviewing the subpoena form and evaluating the fine.

If you would like to help with the internal I-9 audit, please contact Liu Qinghe Law Firm.

The copyright of this article is owned by Liu Qinghe Law Firm.

All materials are written for general information purposes and are intended to give you an idea of our company, our services and the experience of our lawyers. The information provided is not legal advice and should not be relied upon and the information may not be current and subject to change without notice.

Telephone:407-930-8082 (US Orlando)

Telephone:212-653-8082 (US New York)

Telephone:0086-0755-86533531 (CN Shenzhen)

Email:info@celeblaws.com

Orlando: 5050 W Colonial Drive, Orlando, FL 32808, USA

New York: 276 Fifth Avenue Suite 704, New York, NY 10001, USA

Shenzhen:5109 SCIA Tower Tinghai Road, Room 2402, Nanshan Area, Shenzhen, China